Top Trader in Pakistan

Forex trading in Pakistan continues to grow, despite regulatory challenges and limited infrastructure. Among the key figures shaping the industry is Mohammed Ali Lakhani, a trader known for his sharp market predictions and a strong presence in both Forex and crypto communities.

With years of experience in financial markets, Lakhani combines trend trading, scalping, and support/resistance techniques, often educating others through seminars and social media. While his journey has not been without controversy, he remains one of the most recognized trading educators in Pakistan. This article explores Lakhani’s trading methods, psychological principles, and his role in developing trading literacy in South Asia.

Mohammed Ali Lakhani

Mohammed Ali Lakhani is a Pakistani trader and entrepreneur specializing in financial markets, including Forex and cryptocurrencies.

Biography

His exact date and place of birth are unknown, but available information suggests he is from Karachi, Pakistan. Details about his education are limited, though it is believed he studied finance or business.

Career

Lakhani began trading at a young age, initially focusing on Forex before shifting to cryptocurrencies. He founded his own company or investment fund, though the exact names and details vary across sources. Thanks to successful trades and public market predictions, he gained a reputation in trading circles both in Pakistan and internationally.

Public Activities

Lakhani is actively involved in financial education, conducting seminars and webinars on trading. He also maintains a presence on social media (Facebook, Instagram, YouTube), where he shares investment advice and market analysis.

Criticism and Controversies

Some sources have accused him of fraud and mismanagement of investors’ funds, though no confirmed evidence has been presented. Between 2020 and 2023, reports emerged of clashes with Pakistani regulators over cryptocurrency trading, which faces restrictions in the country.

Current Activities

As of today, Lakhani continues to teach trading and manages investment assets. He has a large following in Pakistan and abroad, solidifying his position as a notable figure in the financial markets.

Key Trading Strategies Used/Recommended by Mohammed Ali Lakhani

1. Trend Trading (Trend Following)

Lakhani emphasizes following the trend using technical indicators such as:

- Moving Averages (MA, EMA) – to determine the trend direction.

- ADX (Average Directional Index) – to assess trend strength.

- MACD – to confirm trend reversals or continuations.

Trades are entered after a pullback or breakout of key levels.

2. Support and Resistance Levels

- Trading based on key price levels.

- Using Fibonacci retracements, horizontal levels, and Pivot Points to identify entry zones.

- Lakhani often employs the “bounce off a level” or “confirmed breakout” strategy.

3. Scalping and Intraday Trading

- Short-term trades on lower timeframes (M1, M5, M15).

- Using volume analysis (VWAP, cluster analysis) to confirm trades.

- Taking profits via take-profit orders or when market momentum shifts.

4. Reversal Trading Strategies

- Identifying divergences on RSI, MACD, Stochastic.

- Trading pullbacks after strong price movements.

- Requiring candlestick pattern confirmations (hammer, engulfing, etc.).

5. Risk Management and Psychology

Lakhani stresses the importance of risk control:

- Risk per trade: No more than 1-2% of the account balance.

- Risk-reward ratio: At least 1:2.

- Emotional discipline, consistency, and maintaining a trading journal.

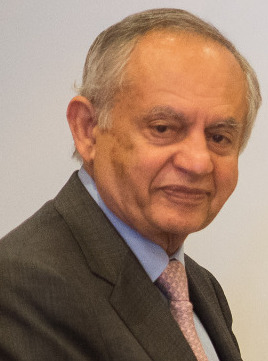

Razak Dawood

Razak Dawood (full name: Abdul Razak Dawood) is a Pakistani businessman and statesman, serving as the Advisor to the Prime Minister of Pakistan on Trade, Investment, and Industry.

Key Biographical Details

- Date and place of birth: Exact date unknown, presumably in the 1940s, Lahore, Pakistan.

- Education: Graduated from the University of Pennsylvania (USA) with a degree in engineering.

Business:

- Founder and head of the Dawood Corporation (including Dawood Hercules Chemicals).

- Played an active role in Pakistan’s industrial development, particularly in the chemical and textile sectors.

Political Activity:

- 1999–2000: Served as Pakistan’s Minister of Industries and Production under Pervez Musharraf’s government.

- Since 2018: Advisor to Prime Minister Imran Khan on Trade, Investment, and Industry (de facto minister).

- Played a key role in shaping the Khan administration’s economic policies, including export promotion and attracting foreign investment.

Controversies:

- Faced criticism for ties to big business and potential conflicts of interest.

- In 2021, sparked debate by suggesting Pakistan should consider trade with India despite political tensions.

Personal Life

Married with children. His son, Samir Dawood, is also involved in business.

Razak Dawood is regarded as one of Pakistan’s most influential business and political figures, playing a significant role in the country’s economy.

1. Trend Following

Concept: Opening positions in the direction of the current trend.

Tools: Moving Averages (MA), ADX, MACD.

2. Scalping

Concept: Quick trades with minimal profit per trade but high frequency.

Tools: Support/resistance levels, order book, VWAP.

3. Swing Trading

Concept: Holding positions for several days to weeks.

Tools: Fibonacci retracements, RSI, chart patterns (head and shoulders, flags).

Example: Buying at a support bounce with a take-profit at resistance.

4. Arbitrage

Concept: Exploiting price differences for the same asset across different exchanges.

Example: Buying BTC on Binance at $60,000 and selling it on Bybit at $60,050.

5. Algorithmic Trading

Concept: Automated strategies based on mathematical models.

Example: Statistical arbitrage (pairs trading).

6. Psychology & Risk Management

- 1% Rule: Never risk more than 1% of capital on a single trade.

- Stop-Loss: Mandatory use of loss-limiting orders.

Here are three key lessons from Riazak Dawood’s experience that can be valuable in trading and business:

1. Adaptability and Flexibility

Dawood worked across various industries—from textiles to government administration. Similarly, in trading, it’s crucial to adapt to changing market conditions, revise strategies, and avoid fixating on a single approach.

2. Long-Term Vision

As a businessman and politician, he focused on sustainable growth, such as promoting Pakistan’s exports. In trading, it’s essential not only to chase quick profits but also to understand long-term trends, manage risks, and preserve capital.

3. Risk Management

In business and politics, mistakes can be costly. Holding high-ranking positions, Dawood had to make calculated decisions. This is equally critical in trading—using stop-losses, diversifying, and controlling emotions help prevent significant losses.

Though Riazak Dawood isn’t a professional trader, his approach to business and decision-making offers valuable principles applicable to financial markets as well.