Top Traders in the US: Jim Simons, Ray Dalio, and Ken Griffin

The United States is home to some of the most influential traders and investors in modern history. From hedge fund pioneers to quantitative trading masterminds, these individuals didn’t just beat the market—they redefined how it’s approached. Whether through cutting-edge algorithms, macroeconomic forecasting, or data-driven decision-making, the best traders in America have consistently delivered outsized returns while managing billions in assets.

In this article, we explore the top traders in the US, focusing on three legendary figures: Jim Simons, the mathematical genius behind Renaissance Technologies; Ray Dalio, the architect of Bridgewater’s macro strategies and the famous All Weather Portfolio; and Ken Griffin, the powerhouse behind Citadel’s dominance in both hedge funds and high-frequency trading. We’ll examine their trading philosophies, key strategies, and what aspiring investors can learn from their approach to risk, data, and long-term success. Whether you’re a retail trader or financial professional, understanding how these top US traders operate can offer valuable insights into today’s global markets.

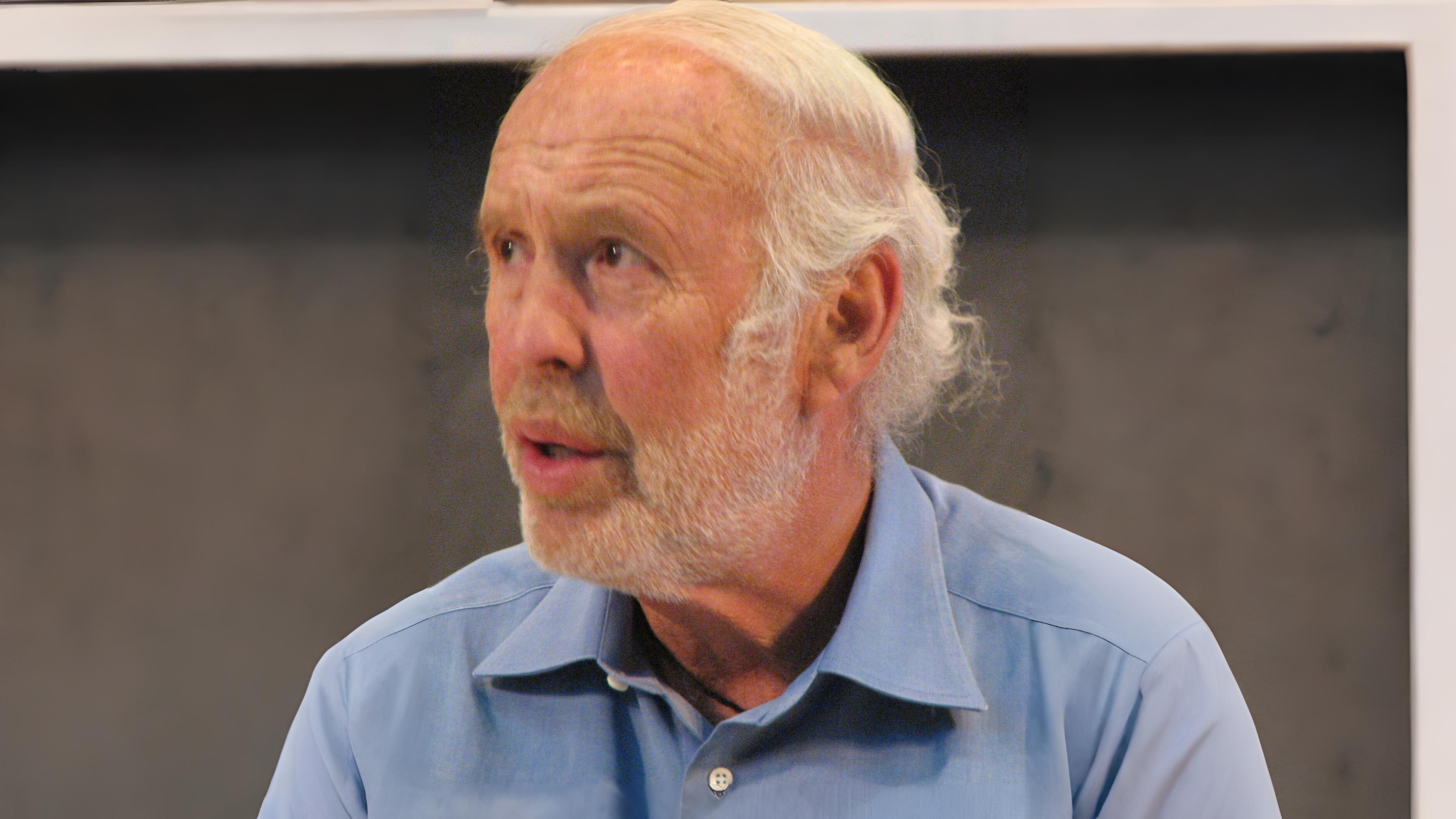

James Harris “Jim” Simons (1938–2024): The Mathematical Billionaire Who Outperformed Wall Street

James Harris Simons (April 25, 1938 – May 10, 2024) was an American mathematician, investor, and philanthropist. Before revolutionizing finance, he:

- Taught mathematics at MIT and Harvard.

- Worked as a codebreaker for the U.S. Department of Defense.

- Won the Oswald Veblen Prize (geometry’s highest honor).

Renaissance Technologies: The Quant Revolution

In 1982, Simons founded Renaissance Technologies, a hedge fund that pioneered algorithmic trading. Key facts:

- Medallion Fund: The firm’s flagship fund averaged 66% annual returns (1988–2018) after fees—the best track record in investing history.

- “Black Box” Strategy: Used complex mathematical models (developed by physicists and mathematicians) to exploit market inefficiencies.

- Elite Team: Hired 60+ world-class scientists (mathematicians, astrophysicists, statisticians) to refine algorithms.

- Secrecy: Employees signed strict NDAs; strategies remain undisclosed.

Performance & Wealth

- 2005–2007: Earned $2.8B, $1.7B, and $1.5B respectively—topping hedge fund manager rankings.

- 2010: Ranked #80 worldwide by Forbes ($8.5B net worth).

- 2006: Named “Smartest Billionaire” by the Financial Times.

- 2007: Despite the subprime crisis, his fund recovered from a -7% drawdown to finish +0.7%.

- Later Years: Launched the RIE Fund (targeting $100B AUM).

Legacy

- The Einstein of Finance: The Economist called him “the most successful investor ever.”

- Philanthropy: Donated billions to math research, autism studies, and education.

- Awards: 2006 Financial Engineer of the Year (FEOY).

Key Strategies of Jim Simons and Renaissance Technologies

1. Quantitative (Algorithmic) Trading

- Complex Mathematical Models: Used to identify hidden market patterns.

- Big Data Analysis: Processed vast datasets to predict price movements.

- Example: Medallion Fund’s 39% average annual returns (after fees) for decades.

2. Statistical Arbitrage

- Pairs Trading: Exploited correlations between related assets.

- Temporary Mispricings: Algorithms detected and capitalized on short-term inefficiencies.

- Example: Profiting from divergences in commodity or stock pairs.

3. High-Frequency Trading (HFT)

- Ultra-Fast Execution: Milliseconds mattered—latency was minimized.

- Liquidity Provision: Algorithms traded thousands of times per second.

- Example: Renaissance’s early dominance in order flow prediction.

4. Machine Learning & AI

- Early Adopter: Used neural networks in the 1980s–90s—long before AI became mainstream.

- Adaptive Models: Continuously updated strategies based on new data.

- Example: Predicting market reversals using pattern recognition.

5. Secrecy & Security

- “Black Box” Approach: Strategies were never disclosed—even to investors.

- Military-Grade Encryption: Protected algorithms from leaks or reverse engineering.

- Example: Employees signed lifetime NDAs; few outsiders understood the models.

3 Key Trading Lessons from Jim Simons

1. Data & Math Beat Intuition

Simons built his success on quantitative trading, not gut feelings.

- Renaissance developed complex algorithms to uncover statistical patterns in market data.

- Key Takeaway: Trading is a science—success comes from data analysis, machine learning, and rigorous backtesting, not speculation.

2. Hunt for Hidden Patterns

Renaissance profited from non-obvious market inefficiencies:

- Correlations between unrelated assets

- Microsecond-level price anomalies

- Seasonal or cyclical distortions

- Key Takeaway: Markets are short-term inefficient. True “alpha” comes from finding edges others miss.

3. Risk Management > Predictions

Even the best models fail. Simons prioritized:

- Position sizing: Never overexpose to a single bet.

- Automated stop-losses: Cut losses before they escalate.

- Extreme diversification: Spread risk across 1000s of trades.

- Key Takeaway: A 99% accurate strategy can still blow up without proper risk controls. Survival comes first.

Raymond Thomas Dalio

Raymond Thomas Dalio (born August 8, 1949) is an American billionaire and hedge fund manager who has served as co-chief investment officer of Bridgewater Associates since 1985. He founded Bridgewater in 1975 in New York.

Dalio was born in New York and attended C.W. Post College of Long Island University. In 1973, he earned his MBA from Harvard Business School.

By 2013, Bridgewater had become the largest hedge fund in the world.

Dalio is the author of the 2017 book “Principles: Life & Work”, which explores corporate management and investment philosophy. As of December 2024, he ranks 124th on Forbes’ list of “The World’s Billionaires”, with a net worth of $15.4 billion.

Early Career and Bridgewater’s Origins

During his time at Harvard, Dalio and his friends started a company that would later become Bridgewater Associates. Initially focused on commodity trading, the venture achieved little success. However, Dalio later reused the name for his hedge fund.

After graduating from Harvard, Dalio moved to Wilton, Connecticut, where he traded from a converted barn. He then worked on the New York Stock Exchange, dealing in commodity futures, before becoming Director of Commodities at Dominick & Dominick LLC. In 1974, he joined Shearson Hayden Stone—a securities firm led by Sandy Weill, who later founded Citigroup—as a futures trader and broker. There, Dalio advised ranchers, grain producers, and other farmers on risk hedging, primarily using futures contracts. However, his tenure ended abruptly when he was fired after drunkenly punching his boss in the face at a New Year’s Eve party.

Founding Bridgewater Associates

In 1975, Dalio founded Bridgewater Associates as a wealth advisory firm, serving corporate clients—many of whom he had worked with at Shearson Hayden Stone. The company began publishing “Daily Observations,” a subscription-based research report analyzing global market trends.

Dalio’s big break came when McDonald’s became a client, accelerating Bridgewater’s growth. The firm soon attracted major clients, including the World Bank’s pension fund and Eastman Kodak. In 1981, Bridgewater opened an office in Westport, Connecticut, where Dalio and his wife wanted to settle down.

Dalio gained wider recognition after profiting from the 1987 stock market crash. In 1991, he launched Bridgewater’s flagship strategy, “Pure Alpha,” which aimed to generate excess returns beyond market performance (measured by the Greek letter alpha). Later, in 1996, he introduced the “All Weather” fund—a pioneering risk-parity strategy designed to deliver steady, low-risk returns.

Ray Dalio’s Investment Strategies: Principles and Trading Approaches

Ray Dalio’s investment philosophy is built on understanding macroeconomic cycles, diversification, and risk management. Below are his key principles and trading strategies.

1. Algorithmic Market Approach

Dalio employs systematic, rule-based strategies driven by historical data and macroeconomic indicators. His fund develops sophisticated models that make automated decisions based on predefined parameters.

2. The “All Weather” Portfolio

One of Dalio’s most famous strategies, the All Weather Portfolio, is designed to perform steadily across all market conditions.

Portfolio Structure:

- 30% Stocks (S&P 500, global indices) → Growth during economic expansions.

- 55% Long-term Government Bonds (US Treasuries) → Protection during recessions.

- 15% Gold & Commodities → Hedge against inflation and crises.

Logic Behind the Strategy:

- Stocks thrive in economic booms.

- Bonds stabilize the portfolio during downturns.

- Gold safeguards against inflation and market crashes.

3. Understanding Debt Cycles

Dalio identifies two key cycles:

- Long-Term Debt Cycles (50-75 years) – Driven by credit expansion and contraction.

- Short-Term Business Cycles (5-10 years) – Fluctuations in economic activity.

Trading Based on Cycle Phases:

- Early Growth Phase → Buy stocks & commodities.

- Peak Debt Phase → Shift to defensive assets (bonds, gold).

- Crisis Phase → Hold cash, short overvalued assets.

- Recovery Phase → Re-enter growth assets.

4. Diversification Across Uncorrelated Assets

Dalio avoids overexposure to any single asset class. His portfolios typically include:

- Stocks

- Bonds

- Commodities (gold, oil)

- Currencies

5. Risk Management Rules

- Never bet everything on one trade → Spread capital across assets.

- Use stop-losses → Automatically exit losing positions.

- Adapt to changing markets → Adjust strategies when conditions shift.

How to Apply Dalio’s Ideas in Trading?

Long-Term Investors → Adopt the All Weather Portfolio + rebalance annually.

Traders → Track macro trends (GDP, inflation, Fed rates) and trade with the cycle.

During Crises → Increase allocations to gold & government bonds.

Dalio’s methods emphasize discipline, data-driven decisions, and resilience—key principles for successful investing in any market environment.

Ray Dalio’s 3 Key Trading Lessons: Markets, Risk & Psychology

(Ray Dalio) — founder of Bridgewater Associates and author of “Principles” — shares invaluable insights on markets, capital management, and trading psychology. Here are three crucial lessons from his experience:

1. “Don’t Trust Me — Trust My Principles”

Core Idea: Markets move in predictable cycles and patterns, not randomly.

How to Apply:

- Study historical patterns (e.g., debt crises, inflation cycles).

- Build data-driven rules, not emotion-based decisions.

- Trust your system, not gut feelings.

“Reality is like a machine with repeating cause-effect relationships.”

2. “Diversification Isn’t About Assets — It’s About Uncorrelated Returns”

Core Idea: True risk protection comes from assets that behave differently under the same conditions.

How to Apply:

- Combine stocks, bonds, commodities (gold), currencies, and alternatives (crypto, real estate).

- Use Risk Parity allocation (like Bridgewater’s All Weather strategy).

- Avoid overconcentration, even in “sure bets.”

“The holy grail of investing is finding 10–15 uncorrelated return streams.”

3. “Mistakes Are Your Best Teacher”

Core Idea: Successful traders aren’t those who avoid mistakes — but those who analyze failures and adapt.

How to Apply:

- Keep a trading journal to document why decisions failed.

- Stress-test scenarios: “What if I’m wrong?”

- Follow the 2% Rule (never risk >2% of capital on one trade).

“Pain + Reflection = Progress.”

Why This Matters

Dalio’s approach blends discipline, empirical analysis, and humility. Whether you’re a long-term investor or active trader, these principles help navigate uncertainty and compound gains over time.

Kenneth Cordelle Griffin

Kenneth Cordelle Griffin (born October 15, 1968) is an American hedge fund manager, entrepreneur, and investor. He is the founder, CEO, co-chief investment officer, and 80% owner of Citadel LLC, a multinational hedge fund. He also owns Citadel Securities, one of the largest market makers in the U.S.

As of March 2025, Griffin’s net worth was estimated at $42.2 billion, ranking him as the 34th richest person in the world and 22nd on Forbes’ 2024 list of the 400 wealthiest Americans.

Philanthropy & Political Influence

- Recognized among America’s most generous donors (Forbes, 2023), having contributed $1.56 billion to causes like education, economic mobility, and medical research.

- A major political donor, Griffin has donated hundreds of millions to Republican and conservative-aligned candidates and organizations.

Key Highlights:

- Citadel LLC: One of the most successful hedge funds, managing ~$60B+ in assets.

- Citadel Securities: Dominates ~27% of U.S. stock market trades (2024).

- Trading Style: Known for quantitative strategies, arbitrage, and market-making.

1. Quantitative & Algorithmic Trading

Core Tools: Machine learning, big data, and statistical models to exploit inefficiencies.

- Statistical Arbitrage:

- Trades correlations between assets (e.g., paired trades in similar stocks).

- Example: Long/short positions in co-moving equities.

- High-Frequency Trading (HFT):

- Citadel Securities executes ~27% of U.S. retail stock orders, profiting from spreads and liquidity provision.

“Markets are a math problem waiting to be solved.”

2. Multi-Strategy Hedge Fund (Citadel LLC)

Diversification across uncorrelated strategies:

- Global Macro: Bets on interest rates, currencies, and commodities (e.g., Fed policy shifts).

- Event-Driven: Capitalizes on mergers, bankruptcies, or buybacks (e.g., arbitraging merger spreads).

- Relative Value: Seeks mispriced assets (e.g., convertible bonds vs. equities).

Why It Works: Losses in one strategy are offset by gains in another.

3. Arbitrage & Market Making

Citadel Securities’ Edge:

- Cross-Exchange Arbitrage: Exploits price delays between NYSE, Nasdaq, etc.

- Liquidity Provision:

- Profits from bid-ask spreads by filling retail orders (e.g., Robinhood’s order flow).

- Handles 1 in every 4 U.S. stock trades.

Controversy: Faced scrutiny during the 2021 meme-stock frenzy (GME, AMC).

4. Fundamental Analysis & Activist Stakes

When Citadel Goes Long-Term:

- Takes large positions to influence management (e.g., pushing for buybacks/spinoffs).

- Example: Led the $2.75B bailout of Melvin Capital during the GameStop short squeeze.

Though Ken Griffin rarely shares detailed strategies, his public statements and practices offer several key lessons for traders and investors.

1. Risk Management Comes First

Griffin has repeatedly emphasized that risk management is the foundation of trading success. In 2008, when many funds collapsed, Citadel survived thanks to strict risk controls.

How to apply:

- Never risk more than you can afford to lose.

- Use stop-losses and diversify your portfolio.

- Avoid excessive leverage.

2. Technology and Data Are Your Edge

Citadel invests billions in technology and algorithmic trading. Griffin believes that informational and technological superiority is critical in today’s markets.

How to apply:

- Utilize analytics and algorithms, even as an individual trader.

- Monitor macroeconomic data and news.

- Automate processes where possible (e.g., using scripts or bots).

3. Adapt or Lose

Markets constantly evolve, and strategies that worked yesterday may fail tomorrow. Griffin successfully restructured his business after the 2008 crisis and continues to compete with the industry’s biggest players.

How to apply:

- Stay flexible—if a strategy stops working, adjust your approach.

- Learn from mistakes—analyze losing trades.

- Keep up with new trends (e.g., cryptocurrencies, AI-driven trading).