Web3 Investing for Beginners: Crypto, Stocks & Allocation

The next era of the internet – Web3 – is reshaping how people interact with technology, money, and ownership. Built on blockchain and decentralization, Web3 replaces middlemen with smart contracts, enabling users to control their assets, data, and identity.

For investors, this shift opens entirely new opportunities – and challenges – that differ sharply from traditional finance.

In this beginner-friendly guide, we’ll explore the fundamentals of Web3 investing, from cryptocurrencies and NFTs to stocks and venture funds. You’ll learn what makes this ecosystem unique, how to identify the best Web3 investments, and how to invest in Web 3.0 without taking unnecessary risks.

Whether you’re curious about staking crypto, buying Web3-related stocks, or diversifying your digital portfolio, this roadmap will help you start smart.

Web3 isn’t just about speculation – it’s about participating in the future of digital ownership and decentralized innovation. By understanding its core protocols, utilities, and technologies, beginners can position themselves early in a movement that may redefine the internet and the global economy alike.

What Is Web3 Investing?

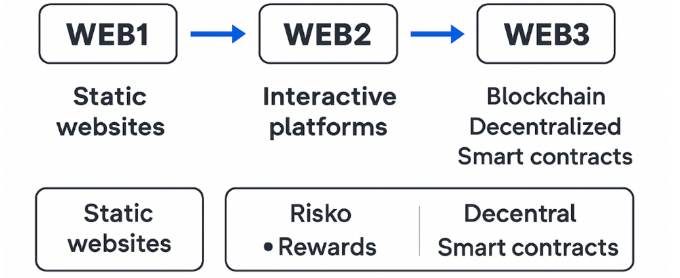

At its core, Web3 investing means allocating capital into the technologies, assets, and companies that power the next generation of the internet. Web3 – short for “Web 3.0” – represents a decentralized digital ecosystem built on blockchain infrastructure.

Unlike Web2, where large corporations control data and digital services, Web3 allows users to own and trade assets directly through smart contracts – self-executing pieces of code that remove the need for intermediaries such as banks, brokers, or centralized exchanges.

In simple terms, Web3 is the financial layer of the internet – and investing in it means taking part in that transformation. Instead of buying shares in a company that controls data (like Facebook or Google), investors buy into tokens, protocols, and decentralized dapps (applications) that distribute ownership among users. Every transaction, agreement, or product exists transparently on the blockchain, allowing anyone to verify and participate.

So, web3 how to invest? The process starts by understanding the new digital building blocks – from cryptocurrencies and staking systems to governance mechanisms that let users vote on project decisions. These instruments replace traditional stocks and bonds with digital equivalents designed to reward participation, liquidity, and innovation.

The key differences between traditional and Web3 investing include:

- Ownership structure. In Web2, users are customers; in Web3, they can be stakeholders. Buying a token or NFT can give you both access and partial ownership of a network or project;

- Transparency. All transactions are visible on-chain, meaning data is verifiable and public, unlike closed corporate ledgers;

- Decentralization. Decisions are distributed across communities through governance tokens and protocols, reducing central control;

- Liquidity and access. Many Web3 assets trade 24/7 across global exchange platforms, giving investors unprecedented flexibility;

- Innovation cycle. The pace of growth is much faster; a small startup or DeFi project can reach global adoption within months.

However, it’s not just about hype or speculation. Successful investing requires the same discipline as any other market: research, diversification, and understanding the utility behind each asset.

Projects without real-world value or functioning protocols often collapse quickly, while those with solid fundamentals – like Ethereum’s role in powering decentralized finance – tend to endure.

Types of Web3 Investments

The Web3 ecosystem offers a wide spectrum of opportunities – from decentralized currencies to publicly traded companies building blockchain infrastructure. Each investment type carries its own mix of risks, rewards, and exposure levels.

For beginners, understanding these categories helps decide where and how to start, depending on one’s allocation, time horizon, and risk tolerance.

Cryptocurrencies and Tokens

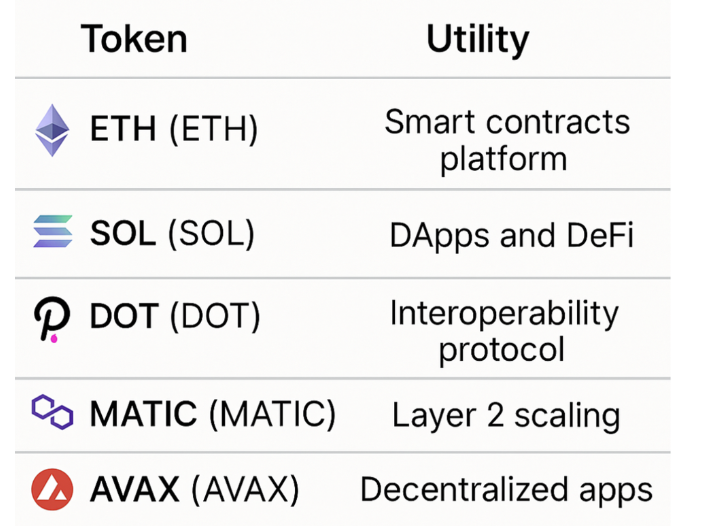

When most people think of Web3, they immediately picture cryptocurrencies. These digital assets form the foundation of the Web3 economy, acting as both currency and infrastructure for decentralized systems. Knowing how to invest in Web3 crypto means identifying which projects have genuine technological value and real-world adoption.

Major networks such as Ethereum (ETH), Solana (SOL), and Polkadot (DOT) offer more than just tradeable coins – they function as full ecosystems for smart contracts, decentralized dapps, and DeFi protocols. Tokens within these ecosystems often have utility beyond speculation: they can be staked for rewards, used to pay network fees, or provide governance rights to vote on future updates.

Below is an example overview of key tokens and their functions:

| Token | Blockchain/Project | Utility | Typical Use Case |

| ETH | Ethereum | Gas for transactions, staking, governance | DeFi apps, NFTs, smart contracts |

| SOL | Solana | Transaction fees, staking | High-speed trading, dapps |

| DOT | Polkadot | Governance, cross-chain transfers | Multi-chain connectivity, parachains |

| MATIC | Polygon | Gas fees, scalability solution | Layer-2 DeFi, gaming |

| AVAX | Avalanche | Staking, governance | DeFi, subnets, NFT markets |

Investors can buy these assets directly on exchange platforms, store them in wallets, and participate in staking or yield-generating activities. However, crypto remains volatile – so diversification across networks and use cases is essential.

Web3 Stocks

For those hesitant to dive into crypto directly, Web3-related stocks provide indirect exposure to the sector’s growth. Understanding how to invest in Web3 stocks means looking for companies that build or support the blockchain economy – from hardware producers to fintech platforms.

Examples include:

- Coinbase (COIN) – the largest crypto exchange in the U.S., acting as a gateway between fiat and digital assets;

- NVIDIA (NVDA) – a leader in GPU production, powering blockchain mining, AI, and metaverse graphics;

- Block (SQ) and PayPal (PYPL) – fintech innovators integrating crypto wallets, peer-to-peer payments, and decentralized features;

- MicroStrategy (MSTR) – a corporate pioneer in holding Bitcoin as a treasury asset.

Investing in these companies through traditional brokerage accounts gives investors regulated access to the Web3 sector without managing tokens directly. Stock-based exposure tends to be less volatile but still reflects broader crypto market sentiment.

NFTs and Metaverse Projects

The NFT (non-fungible token) boom introduced a new dimension to Web3 – digital ownership of art, collectibles, and virtual land. Within the metaverse, NFTs represent identity, real estate, or assets inside virtual worlds like Decentraland and The Sandbox.

These projects operate on dapps and blockchain protocols where scarcity and uniqueness create market value. While the concept has matured, it remains one of the riskiest segments of Web3 due to extreme volatility and speculative bubbles. Prices can fluctuate dramatically, and liquidity often dries up in downturns.

Still, for investors with a high tolerance for risk, NFTs offer exposure to emerging sectors like virtual real estate, gaming economies, and creator-driven platforms. Success here depends on evaluating utility, community strength, and integration with broader metaverse ecosystems.

Web3 Startups and Venture Funds

At the frontier of innovation, startups are building the next wave of decentralized protocols, tools, and applications. Early-stage venture investing in this space can be highly rewarding – but it also carries elevated risks due to limited data, regulation, and liquidity.

Investors interested in diversification can allocate a portion of their portfolio to professionally managed venture funds, which spread exposure across projects in DeFi, infrastructure, and NFT platforms. Well-known names include a16z Crypto, Pantera Capital, Delphi Ventures, and Framework Ventures.

Some platforms even allow small investors to participate through tokenized venture products or community-driven DAOs. These funds usually target long-term capital appreciation by backing projects before they list publicly or issue tradable tokens.

How to Build a Web3 Portfolio

Building a strong portfolio is about balance – not chasing the hottest coin or trend. Since the sector is young and volatile, your results will depend largely on allocation, diversification, and risk management. A Web3 investment strategy combines several asset types – from cryptocurrencies and stocks to venture funds – each offering different exposure, liquidity, and potential returns.

The starting point is understanding allocation, which means distributing your capital across assets with varying risk profiles. In Web3, that usually includes:

- Crypto and tokens. High-risk, high-reward assets driven by innovation and market cycles;

- Public stocks. Moderate-risk exposure through companies building blockchain infrastructure or integrating DeFi and wallet technology;

- Venture and index funds. Lower liquidity but more stability through diversified exposure to early-stage startups and protocols.

A balanced structure helps you benefit from both growth and stability while minimizing exposure to single-asset shocks. Here’s an example of a simple, diversified Web3 allocation for a long-term investor:

| Asset Class | Allocation % | Example Investments | Risk Level | Goal |

| Cryptocurrency & Tokens | 60% | Ethereum, Solana, Polkadot, DeFi tokens | High | Growth, innovation exposure |

| Web3 Stocks | 20% | Coinbase, NVIDIA, fintech firms | Medium | Stable access to blockchain ecosystem |

| Venture Funds / Index Products | 20% | a16z Crypto, Pantera, DAO-based funds | Medium–High | Early-stage participation, diversification |

This structure balances liquidity and opportunity. The crypto portion provides exposure to fast-moving innovation and staking yields; stocks deliver stability through regulated markets; and funds or venture allocations spread long-term bets across multiple projects.

Why Diversification Matters

Diversification is more than just holding several assets – it’s about blending different protocols, geographies, and investment instruments. The Web3 ecosystem is still fragmented: a bug in one smart contract, a failed exchange, or a change in governance policy can wipe out value overnight. By diversifying, you’re not betting on one token or company, but on the evolution of the Web3 infrastructure as a whole.

Investors should also revisit allocations regularly. In bull markets, crypto holdings may balloon and dominate your portfolio, increasing volatility. Rebalancing – selling some winners and reinvesting in undervalued areas – helps preserve gains while keeping risk under control.

Evaluating the Best Web3 3.0 Investments

Choosing the best Web 3.0 investments depends on your timeframe and risk appetite. Conservative investors may prefer regulated assets such as Web3-related stocks or diversified ETFs, while those comfortable with higher volatility might lean toward tokens and DeFi protocols.

Here’s a simplified decision approach:

- Short-term focus. Trade liquid cryptocurrencies or blue-chip tokens like ETH and MATIC;

- Medium-term growth. Hold shares in public blockchain firms or gaming/metaverse projects;

- Long-term vision. Invest in venture or index funds tied to Web3 startups and early-stage infrastructure.

Regardless of the approach, smart investors treat Web3 as a component of a broader strategy – not a replacement for traditional investments. Keep core holdings in stable assets, allocate a calculated portion to innovation, and ensure every investment has clear utility or long-term potential.

Risks and Rewards of Web3 Investing

Like every frontier market, it offers both immense potential and serious uncertainty. The blend of blockchain innovation, decentralized governance, and fast-moving technology brings opportunities that traditional finance can’t match – but it also introduces risks that new investors often underestimate. Understanding this balance between volatility and value creation is crucial before building exposure to the sector.

The Risks:

- Volatility and market instability. Prices move faster than in any other asset class. Tokens can swing 20-30% in a single day due to speculation, sentiment, or macroeconomic events. While this volatility can create short-term trading opportunities, it also increases the likelihood of losses for inexperienced investors;

- Security vulnerabilities and hacks. Unlike traditional markets, the decentralized nature of Web3 means there’s no central authority to reverse a transaction. Smart contract bugs, protocol exploits, and compromised wallets can lead to permanent loss of funds. In 2024 alone, over $1 billion was stolen across DeFi platforms through vulnerabilities in governance or coding errors;

- Regulatory uncertainty. Governments are still defining how to regulate tokens, exchanges, and dapps. Sudden changes – like bans, new taxation policies, or restrictions on staking – can impact entire ecosystems overnight. Investors must stay informed about local laws and regulatory frameworks before committing large capital;

- Liquidity and project failure. Many startups and protocols never reach maturity. Token prices can collapse if developer teams dissolve, funding runs out, or competitors overtake their niche. Even promising ventures can face liquidity traps where holders can’t exit without steep losses;

- Governance risks. Decentralized governance sounds democratic, but it’s not immune to manipulation. Large token holders (“whales”) can dominate votes, directing protocols toward self-interest instead of community goals. Weak or inactive communities often leave critical updates in limbo.

The Rewards:

- High growth potential. Despite the turbulence, successful projects have delivered returns unmatched by traditional assets. Early investors in major networks like Ethereum or Polygon saw exponential rewards as adoption expanded across industries – from finance to gaming and supply chains;

- Early adopter advantage. Web3 remains a developing ecosystem, meaning those who participate early can capture opportunities before they become mainstream. In the same way early internet investors gained from Amazon or Google, Web3 pioneers benefit from first-mover exposure to foundational protocols and technologies;

- Ownership and participation. Unlike passive stockholders, Web3 investors can actively shape ecosystems through staking, voting, and community engagement. This model blends user participation with financial incentives, giving holders a voice in product direction and governance outcomes;

- Global accessibility. Anyone with an internet connection and a wallet can access Web3 markets – no need for banks or brokers. This democratization of finance opens doors for individuals in developing economies to participate in innovation and wealth creation directly;

- Portfolio diversification. Adding Web3 exposure to a traditional portfolio of stocks or bonds can improve risk-adjusted returns. While short-term volatility remains high, long-term correlations with traditional markets are relatively low, offering diversification benefits during economic cycles;

- Balancing Risk and Reward. Smart Web3 investing isn’t about chasing hype – it’s about understanding risk-reward asymmetry. Every token, dapp, or DeFi protocol should be evaluated for fundamentals: technology, team credibility, security audits, and community engagement. Diversification and position sizing matter more than timing.

Those who manage exposure carefully – keeping only a portion of their allocation in high-risk assets – can enjoy the innovation upside while protecting capital from inevitable downturns. In the Web3 era, success comes from being both bold and cautious.

Web3 Tools for Investors

To succeed in the Web3 investment space, beginners need more than just market knowledge – they need the right tools. Unlike traditional finance, where everything runs through banks or brokers, Web3 operates through decentralized infrastructure.

This includes wallets, exchange platforms, and DeFi protocols that let investors hold, trade, and grow their digital assets directly. Understanding how these tools work – and which ones to trust – is essential for anyone looking to build confidence and security in this ecosystem.

Wallets: Your Digital Vault

A wallet is the cornerstone of every Web3 investor’s setup. It’s not just a storage app – it’s your key to the decentralized internet. Wallets allow users to store tokens, interact with dapps, and sign transactions securely without intermediaries.

There are two main types of wallets:

- Hot wallets – connected to the internet and convenient for frequent transactions (e.g., MetaMask, Trust Wallet, Phantom).

- Cold wallets – hardware-based devices like Ledger or Trezor that keep your private keys offline for maximum security.

A good Web3 wallet does more than just hold funds. It acts as your identity across the blockchain ecosystem, linking you to DeFi apps, NFT marketplaces, and staking platforms. Some wallets now include built-in swaps, portfolio dashboards, and utility trackers that show real-time earnings from staking or liquidity pools.

Exchanges: The Gateway to Web3 Assets

Once you have a wallet, the next step is accessing exchange platforms – where you buy, sell, and swap cryptocurrencies and Web3-related tokens. Exchanges come in two forms:

- Centralized Exchanges (CEX) – platforms like Binance, Coinbase, and Kraken. They offer liquidity, user-friendly interfaces, and fiat on-ramps for beginners.

- Decentralized Exchanges (DEX) – protocols like Uniswap, SushiSwap, and PancakeSwap that allow peer-to-peer trading directly from your wallet.

For newcomers, centralized platforms may feel safer due to customer support and regulation, but DEXs represent the true Web3 model: full control over funds, transparency, and global access.

Many exchanges also provide staking services, where investors can earn passive income by locking up tokens to support network security or liquidity pools. Returns depend on each protocol’s design and the length of the staking period – ranging from 3% on major coins to over 10% on smaller networks.

DeFi Platforms: Where Web3 Finance Happens

DeFi (Decentralized Finance) platforms are the engines of Web3’s investment landscape. They recreate the services of traditional finance – lending, borrowing, savings, and trading – but remove intermediaries like banks or brokers. Everything runs on smart contracts that execute automatically based on transparent code.

Popular DeFi ecosystems include:

- Aave – for decentralized lending and borrowing;

- Curve – for stablecoin trading and liquidity provision;

- Lido – for staking ETH and other tokens in return for liquid rewards;

- Uniswap – a decentralized exchange protocol that allows token swaps without order books.

Investors use these platforms not just for speculation but for generating yield. For example, a user might deposit ETH into a lending pool on Aave, earn interest from borrowers, and simultaneously stake their rewards for compounding growth.

However, while the opportunities are vast, DeFi carries technical and market risks. Smart contract bugs, sudden liquidity drops, or governance failures can result in losses. That’s why security audits, community reputation, and understanding protocol utility are crucial when choosing where to participate.

Connecting Everything: Dapps and Integrations

What ties all these tools together are dapps – decentralized applications that function as gateways to the Web3 world. These include NFT marketplaces like OpenSea, yield aggregators like Yearn, and on-chain analytics tools such as DeBank or Zapper. Many wallets now integrate directly with these dapps, allowing seamless execution of trades, swaps, or staking actions without leaving your dashboard.

This interconnected structure defines the utility of Web3: investors no longer rely on institutions to move or multiply capital – they rely on code, transparency, and participation.

Building a Secure Setup

For beginners, a simple Web3 toolkit might look like this:

- Wallet. MetaMask for daily use + Ledger Nano for cold storage;

- Exchange. Coinbase or Binance for buying assets;

- DeFi access. Aave or Uniswap for yield and trading;

- Portfolio tracking. Zapper or DeBank for real-time updates.

Each component supports the next, forming a self-contained financial system that runs entirely on the blockchain.

Beginner Mistakes to Avoid

Every new investor in Web3 eventually makes a few rookie errors – but some of them can be costly. The decentralized space gives you full control over your money, yet that freedom comes with full responsibility. Knowing which mistakes to avoid early on can protect your portfolio and help you grow with confidence.

The three biggest pitfalls are lack of research, poor storage practices, and ignoring risk management. Many beginners buy trending tokens without understanding their utility, keep all funds on centralized exchanges, or chase high rewards without considering volatility. In Web3, that combination can wipe out profits quickly.

The table below summarizes the most common beginner mistakes, their consequences, and safer alternatives to build better habits:

| Mistake | Consequence | Better Approach / Alternative |

| Investing without DYOR | Losses in scam projects or failed tokens | Research whitepapers, audits, and community activity before buying |

| Keeping all funds on exchanges | Loss of funds due to hacks or withdrawal bans | Use self-custody wallets (MetaMask, Ledger) for storage |

| Ignoring risk management | Full portfolio crash during volatility | Diversify across tokens, stocks, and funds; rebalance regularly |

| Overusing leverage | Liquidation in high-volatility trades | Trade spot or small-margin positions only after experience |

| Clicking random links or signing unknown transactions | Wallet drained by malicious dapps | Verify contracts and URLs; use hardware confirmation |

| FOMO buying after price spikes | Buying tops, emotional investing | Set buy zones and stick to a long-term plan |

The key takeaway: Web3 rewards careful, informed participation – not impulsive moves. Treat your investments like a business: plan your allocation, secure your assets in a wallet, and never stop learning. A small dose of discipline goes a long way toward long-term success in this volatile, fast-moving space.

FAQ

What are the best Web3 investments today?

Leading options include Ethereum, Solana, Web3 infrastructure stocks like Coinbase and NVIDIA, and top DeFi or metaverse projects.

How to invest in Web3 crypto?

Buy major tokens on reputable exchanges, store them in a secure wallet, and consider staking or DeFi platforms for passive income.

Is it possible to buy Web3 stocks?

Yes, companies like Coinbase, Block, and NVIDIA provide indirect exposure through traditional markets.

What is the safest way to start Web3 investing?

Begin small, use trusted wallets, diversify your allocation, and focus on assets with proven utility and community support.

How risky is Web3 compared to traditional investments?

Web3 is more volatile and less regulated but offers higher potential rewards for early, well-informed investors.

Conclusion

Web3 is both an opportunity and a challenge – a fast-growing space where innovation meets volatility. For beginners, the key is to start small, stay informed, and build a balanced allocation across crypto, stocks, and funds. With patience, research, and discipline, investors can capture the upside of decentralization while keeping risks under control.