German Property Market for Investors: Yields, Regions & Risks

The German property market stands as one of Europe’s most resilient and attractive destinations for real estate investors. Known for its economic stability, strong legal protection, and high rental demand, Germany has long been a safe haven for both domestic and international buyers. Even during periods of global uncertainty, the market has maintained consistent growth, supported by solid GDP performance and steady population trends.

For those exploring German property investment, the appeal lies in balance – moderate returns combined with low volatility and transparent regulation. The real estate sector benefits from strong demand across urban centers like Berlin, Munich, and Frankfurt, where limited supply continues to drive up prices.

At the same time, institutional and private investors are diversifying their portfolios by adding residential and commercial assets from emerging cities such as Leipzig and Dresden.

Germany’s mix of economic reliability, strict construction standards, and responsible lending practices make it particularly appealing for long-term investment strategies.

Whether you’re searching for real estate for sale in Germany as an income-producing asset or a capital-preservation tool, the fundamentals remain strong – but the key lies in understanding regional differences, yield dynamics, and regulatory nuances.

Overview of the German Property Market

The German property market has experienced one of the most sustained growth cycles in Europe, with housing prices rising almost every year since 2010. Despite global slowdowns, the country’s real estate sector continues to attract both local and foreign investors due to its reputation for stability and legal transparency.

Whether browsing real estate for sale in Germany for residential or commercial purposes, buyers are drawn to a market that offers gradual, predictable capital appreciation rather than speculative spikes.

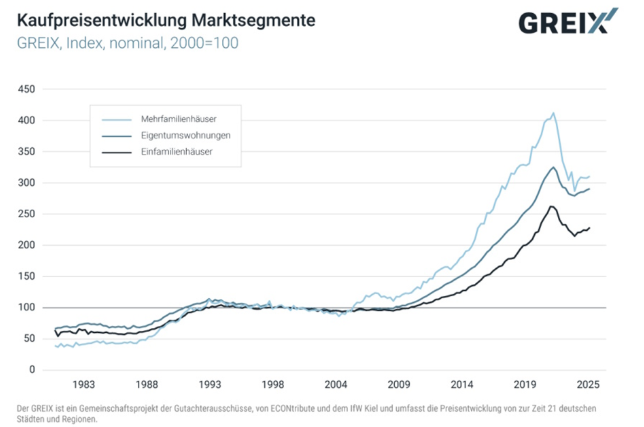

Over the past decade, residential property prices have increased by an average of 65–80% nationwide. This trend accelerated between 2015 and 2022, driven by low interest rates and growing demand in metropolitan areas. Even with recent corrections in 2023–2024, property values remain significantly higher than a decade ago.

The national price index for apartments and houses roughly doubled between 2010 and 2025, according to data from the Federal Statistical Office and major real estate platforms tracking real estate for sale in Germany.

This consistent rise is closely tied to the strength of the broader economy. Germany’s GDP has remained one of the most stable in the EU, with robust manufacturing, export, and service sectors providing income security for households. Low unemployment and high purchasing power have supported continuous demand for quality housing.

Inflation, however, has started to influence the market in recent years. Rising construction and energy costs have pushed developers to increase prices, while the European Central Bank’s response – higher interest rates – has made financing more expensive. This has slowed short-term growth but reinforced the long-term nature of the market. Investors now focus more on yield sustainability and regional potential rather than rapid appreciation.

The distinction between urban and rural regions is a defining feature of the German real estate landscape. Major cities like Berlin, Munich, Frankfurt, and Hamburg have seen intense competition and limited supply, leading to higher rental prices and lower yields. These urban centers attract young professionals, international students, and migrants, all contributing to constant occupancy levels and solid demand.

In contrast, rural areas remain affordable but offer slower growth and weaker liquidity. Prices there are often 50-70% lower than in metropolitan zones, yet they can provide stable returns for investors focused on long-term rental income or lifestyle purchases such as holiday homes and small family properties. The key difference lies in population dynamics: while cities continue to grow, many smaller towns face demographic decline, influencing both pricing and future value.

Another important factor is government regulation – particularly rent controls and zoning laws. These measures, aimed at protecting tenants and managing construction density, vary by region and have a direct impact on yield and investment potential. Investors looking for real estate for sale in Germany must therefore assess not only market prices but also the legal environment in each city.

Demand, Supply, and Demographics

The dynamics of demand and supply in the German real estate sector are deeply influenced by demographic changes. Over the past decade, major urban centers have seen strong population growth, while many rural regions have experienced decline. This imbalance continues to shape where and how investors find profitable opportunities.

Germany’s demographics show a steady increase in population, reaching over 84 million in 2024 – a record high. The main drivers are internal migration toward cities and continued immigration from EU and non-EU countries. This growing, mobile population has created consistent housing demand, especially for rental properties in urban areas.

- Urban migration and job concentration. Economic activity is centered in large metropolitan areas such as Berlin, Munich, Hamburg, and Frankfurt. People move there for employment, pushing demand up while limited land and strict zoning laws restrict new housing supply.

- Academic and student population. Germany attracts hundreds of thousands of international students each year, many of whom prefer to rent near universities. This creates additional pressure in mid-sized cities like Leipzig, Dresden, and Heidelberg, where the student population can represent 10-20% of local residents.

- Limited construction and high costs. Rising material prices and labor shortages have slowed construction projects. Developers often focus on high-end housing, leaving affordable rentals in short supply.

- Demographic aging. While older generations tend to remain homeowners, younger workers increasingly rely on rentals, reinforcing the rental culture that defines the German market.

Because of these factors, urban regions consistently deliver higher rental yields than rural areas. Cities like Berlin and Hamburg see occupancy rates above 97%, driving steady income even with moderate rent controls. Rural regions, in contrast, offer lower yields due to weaker population growth and less liquidity, but may appeal to investors seeking stability and lower entry prices.

The table below summarizes the current balance between demand and supply in three representative cities:

| City | Demand Trend | Supply Trend | Rental Yield (approx.) | Key Demographic Drivers |

| Berlin | Very high, driven by young professionals and migrants | Limited by zoning and land scarcity | 3-4% | Employment growth, international migration |

| Hamburg | High, supported by logistics and port industry | Moderate; new builds in peripheral zones | 3% | Population inflow, student housing |

| Leipzig | Rising rapidly, still affordable for new entrants | Expanding due to new construction | 4-5% | Students, creative industries, internal migration |

In summary, Germany’s property demographics favor large and mid-sized urban markets where demand far outpaces supply. Investors targeting these regions can expect stronger rental performance, while rural areas remain suitable for long-term holds with lower risk but limited capital appreciation.

Rental Yields and Investment Opportunities

When evaluating German property investment, one of the first metrics investors examine is rental yield – the annual rental income expressed as a percentage of the property’s purchase price.

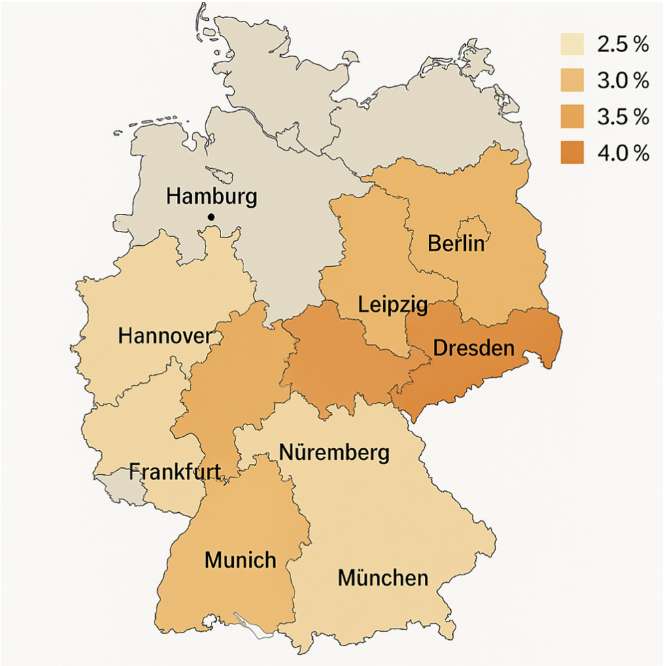

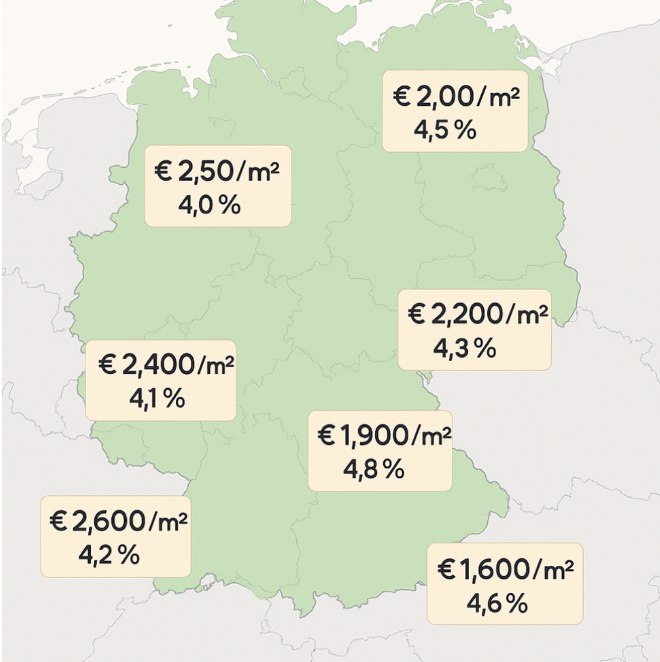

Across the country, yields typically range between 2% and 5%, depending on location, property type, and local demand. Major cities offer lower yields but higher capital appreciation, while emerging regions provide better cash flow with slightly higher risk.

For foreign investors searching for investment property for sale Germany, the range of opportunities is wide. From established urban districts with luxury apartments to new residential developments in fast-growing cities, the German market allows diversification across multiple segments.

Residential Apartments

Residential properties remain the most popular choice among both domestic and foreign investors. They combine liquidity, strong rental demand, and stable occupancy. In urban centers like Berlin, Munich, or Hamburg, yields average 2-3%, reflecting both high prices and intense competition. However, these same cities offer the best prospects for long-term capital appreciation, as population growth and restricted supply continue to push values upward.

In contrast, mid-sized cities such as Leipzig, Dresden, and Hanover deliver yields of 4–5%, mainly due to lower entry prices and younger tenant demographics. Investors targeting cash flow rather than speculation often prefer these markets, especially when buying smaller apartments near universities or business hubs.

Commercial Real Estate

The commercial sector – offices, logistics centers, and retail spaces – appeals to investors seeking higher returns and longer lease contracts. Yields for well-located commercial properties typically range from 4% to 6%, depending on the region and tenant profile. Cities like Frankfurt and Cologne, with strong financial and industrial bases, remain the most active.

However, this segment demands careful due diligence and professional management. Vacancies in office buildings or retail zones can reduce profitability, and regulation around commercial zoning can slow project approvals. That said, the best commercial assets provide stable cash flow, inflation protection, and valuable diversification within an investment portfolio.

New Developments and Developers’ Projects

Germany’s strict construction standards and sustainability goals have fueled demand for energy-efficient new builds. Major developers now focus on eco-certified projects with smart-home systems and optimized layouts. These new developments often cost more upfront but attract high-quality tenants and minimize maintenance costs.

Pre-construction purchases (known as Neubauprojekte) can offer discounts of 5–10% compared to finished apartments. For long-term investors, they combine capital appreciation potential with solid rental performance once completed. However, timelines and cost overruns remain key risks, especially during inflationary periods.

Regional Yield Variations

Rental returns differ sharply between urban and rural markets:

- Munich, Frankfurt, Hamburg: 2-3% – low yields, high capital stability;

- Berlin: 3-4% – strong rental demand, moderate entry prices;

- Leipzig, Dresden, Essen: 4-5% – higher yields, growing populations;

- Rural regions: 5%+ possible, but liquidity and resale potential are lower.

For most investors, a balanced strategy combining high-growth urban property and income-focused regional assets offers the best overall portfolio performance.

Before diving into the numbers, it helps to see how typical property types perform. The table below shows average rental yields across segments.

| Property Type | Average Price (€) | Monthly Rent (€) | Yield (% p.a.) |

| Apartment (Berlin) | 350,000 | 1,100 | 3.8% |

| Apartment (Leipzig) | 200,000 | 800 | 4.8% |

| Commercial unit (Frankfurt) | 600,000 | 2,500 | 5.0% |

| Villa (Munich suburbs) | 1,200,000 | 3,000 | 3.0% |

| New build (Dresden) | 280,000 | 950 | 4.1% |

These figures underline Germany’s balanced risk-reward profile: moderate yields, strong legal protection, and slow but steady capital appreciation. Whether targeting investment property for sale in Germany for income or long-term value, investors benefit from a stable, well-regulated market backed by consistent demand and disciplined supply.

Risks and Challenges of German Property Investment

Every stable market carries its share of challenges, and the German property market is no exception. While it remains one of Europe’s safest destinations for real estate, investors must understand that stability comes with strict regulation, slower returns, and rising operational costs.

Before deciding whether buying property abroad is a good investment, it’s essential to weigh both the advantages and the structural risks shaping Germany’s real estate landscape.

Rent Regulation and Zoning Laws

Germany’s housing market is heavily influenced by government regulation aimed at tenant protection. Many cities – especially Berlin, Munich, and Hamburg – enforce rent control measures (Mietpreisbremse) that limit annual increases and cap rental prices for new leases. While these policies protect affordability, they reduce short-term profitability for landlords and slow capital appreciation.

Additionally, zoning rules restrict large-scale construction in central districts, limiting supply even where demand is highest. New projects must comply with environmental and energy-efficiency standards, which add time and cost to development. For developers and institutional investors, navigating these local planning procedures requires patience and expert legal guidance.

Taxation and Transaction Costs

Germany’s tax system is transparent but far from light. Beyond the property transfer tax (3.5-6.5%), buyers face annual property ownership taxes and, in some cases, income tax on rental profits. Capital gains from selling a property within ten years of purchase are also taxable, which discourages speculative activity.

While these taxes contribute to market stability, they reduce net returns and require careful financial planning. Investors managing a broader portfolio across countries should also check double-taxation treaties to avoid being taxed twice on the same income.

Rising Construction and Maintenance Costs

In recent years, construction prices have surged due to material shortages, stricter sustainability standards, and higher wages in the building sector. Developers are under pressure to meet environmental certifications such as KfW Efficiency House and Energy Pass ratings, which, although beneficial in the long term, significantly increase upfront costs.

For investors purchasing new builds or renovation projects, this trend directly affects profit margins. Older properties, on the other hand, may require expensive modernization to comply with new energy regulations, adding hidden costs to what initially seems like a bargain deal.

Macroeconomic Environment: Inflation, Interest Rates, and ECB Policy

Since 2021, global inflation has influenced both property values and financing conditions in Germany. The European Central Bank’s (ECB) tightening cycle raised mortgage rates from below 1% to around 3-4%, sharply increasing borrowing costs. This has cooled the pace of transactions and made financing more selective, especially for foreign buyers.

While rising rates have temporarily slowed capital appreciation, they’ve also prevented overheating. For long-term investors, the correction phase may represent an opportunity to acquire assets at more realistic valuations. However, it’s crucial to stress-test cash flows under different interest-rate scenarios before expanding a portfolio.

Liquidity and Exit Risks

Unlike highly speculative markets, German property is known for its slow-moving nature. Selling an asset can take several months, particularly in rural regions or smaller towns with limited demand.

This makes real estate a less liquid investment compared to stocks or bonds. Investors focused on quick flips or short-term capital gains may find Germany’s market too conservative for their strategy.

In short, Germany remains a secure and transparent market – ideal for portfolio diversification and steady income – but investors should not expect instant profits or explosive growth. The trade-off for security is regulation, the trade-off for sustainability is cost, and the trade-off for stability is slower yield growth.

Regional Analysis – Best Cities and Regions

Germany’s property market is not uniform – it’s a mosaic of local submarkets, each with distinct dynamics in pricing, rental yields, and capital appreciation potential. Investors who understand these regional contrasts can build more balanced portfolios, combining stable urban holdings with affordable regional properties. Below is a closer look at the country’s most active and promising regions.

Berlin and Hamburg

Berlin and Hamburg remain the engines of rental demand in Germany. Both cities attract professionals, creatives, and international students, leading to occupancy rates above 97%. However, limited supply, strict regulation, and capped rents mean yields here are relatively modest – typically around 3–4%.

Berlin has transformed from a low-cost capital into one of Europe’s top cultural and business hubs. Its expanding tech scene, international universities, and start-up ecosystem keep driving population growth, but strict rent control (Mietpreisbremse) continues to restrain income potential. Investors targeting Berlin often focus on long-term capital gains rather than short-term cash flow.

Hamburg, by contrast, combines economic strength with maritime logistics and a robust middle-class tenant base. The port and media sectors provide consistent employment, ensuring strong rental stability even during downturns. New construction in surrounding districts is helping to ease pressure, but yields remain low – around 3% – due to high entry prices.

Munich and Frankfurt

Munich and Frankfurt are Germany’s premium real estate markets. They represent security, prestige, and reliable capital appreciation. Properties here are expensive – often double the national average – but their liquidity and resilience make them a cornerstone in any German property investment portfolio.

Munich consistently ranks among the top cities for living standards, supported by a strong industrial base, major corporations, and top-tier universities. With limited land and strict zoning, new construction is scarce, pushing prices steadily upward. Yields rarely exceed 2.5-3%, but capital growth remains one of the highest in the country.

Frankfurt, Germany’s financial hub, benefits from international banks and institutions, especially post-Brexit relocations. Demand for both office and rental housing stays solid. High prices and competition from institutional investors keep yields tight, yet the city offers long-term appreciation and high liquidity for those focused on wealth preservation.

Leipzig and Dresden

Leipzig and Dresden are often called Germany’s “new growth frontier.” These eastern cities have reinvented themselves as vibrant, youthful, and affordable alternatives to western hubs. For investors seeking strong rental yields, both cities provide excellent value, typically 4-5% annually.

Leipzig has seen a surge in population due to affordable housing, cultural revival, and a growing services sector. It’s also a major student city, which keeps demand for small apartments high. Dresden, with its blend of historic architecture and thriving research institutions, attracts engineers, scientists, and young professionals, ensuring consistent rental income and future capital potential.

Both cities benefit from ongoing construction projects and municipal support for urban renewal, providing entry-level opportunities for first-time investors.

Smaller Towns and Rural Areas

Outside the big cities, rural and smaller-town markets present a different picture. Prices can be 50-70% lower than in urban centers, creating a low entry barrier for private buyers. Typical yields range from 4.5-6%, but liquidity is limited – finding tenants or reselling properties takes longer.

These areas appeal to investors looking for stable returns without heavy competition. Many developers now target regional towns near transport hubs, creating small residential complexes that balance affordability with reasonable yields. However, demographics remain a long-term concern: aging populations and migration to larger cities can slow capital appreciation.

Still, rural real estate offers resilience in volatile markets – lower prices, fewer speculative bubbles, and steady occupancy among local families or retirees.

Case Studies and Historical Trends

Looking back over the past fifteen years, the German property market stands out for its consistency. While other European markets saw sharp cycles of boom and correction, Germany maintained a steady upward trajectory, supported by strong demand, controlled supply, and disciplined financing. For investors, this has translated into predictable rental yields and sustainable capital appreciation rather than speculative gains.

Long-Term Price Growth: 2010 → 2020 → 2025

Between 2010 and 2020, residential property prices in Germany rose by approximately 70%, driven by urban migration, low interest rates, and growing investor confidence. From 2020 to 2025, growth has slowed slightly – averaging 3-4% annually – but the direction remains positive. Inflation and higher interest rates have moderated demand, yet construction shortages and population increases continue to keep prices firm:

- 2010: Average price per square meter nationwide – €1,800;

- 2020: Average price per square meter – €3,200;

- 2025: Projected average – €3,600-3,800.

The index of house prices nearly doubled between 2010 and 2025, while rental income also climbed steadily, especially in large urban markets like Berlin, Frankfurt, and Munich. Even after accounting for inflation, real growth remains positive, confirming the resilience of German real estate as a long-term investment.

Comparing Investment Returns Across Decades

A closer look at average returns reveals how timing affects yield and appreciation:

| Period | Average Annual Capital Growth | Average Rental Yield | Total Return (10-year) |

| 2010–2020 | 6-7% | 3-4% | ~80-90% cumulative gain |

| 2020–2025 | 3-4% | 2.5-3.5% | ~20-25% cumulative gain |

| Projection 2025–2035 | 4-5% | 3-4% | ~50-60% cumulative gain |

These figures illustrate that even during periods of economic tightening, the market continues to reward patient investors with stable, inflation-protected returns. The combination of moderate rental income and enduring capital growth has made German property an anchor in diversified portfolios.

Case Study: €200,000 Investment Over 10 Years

Let’s consider an example to illustrate how long-term value builds up in practice.

In 2015, an investor bought a small apartment in Leipzig for €200,000. The property generated a rental yield of around 4.5%, or €9,000 per year before expenses. During the next decade, the city’s population and employment base expanded, pushing property prices upward.

| Year | Property Value (€) | Annual Rent (€) | Net Yield (% p.a.) | Cumulative Return (€) |

| 2015 | 200,000 | 9,000 | 4.5% | – |

| 2020 | 260,000 | 9,800 | 3.8% | 59,000 (value + income) |

| 2025 | 300,000 | 10,500 | 3.5% | 95,000 (value + income) |

After ten years, the total return equals roughly 47% appreciation in value plus €95,000 cumulative income and growth – a robust performance in a low-volatility environment. Even when adjusting for inflation, the investment comfortably outperforms government bonds or savings accounts over the same period.

Historical Context and Investor Takeaways

The German market’s long-term trajectory shows that steady growth beats short-term speculation. Investors who entered between 2010 and 2015 benefited most from rapid post-crisis expansion, but even later entrants have preserved and increased their capital through disciplined rental income and low vacancy rates.

Looking forward to 2030 and beyond, demographic strength, limited construction, and conservative banking practices will likely sustain this trend. The country’s urban markets may see slower appreciation, but the foundation of the German property investment model – stable cash flow, reliable tenants, and predictable appreciation – remains firmly intact.

FAQ

Is buying property in Germany a good investment?

Yes, it offers stable long-term growth, strong tenant demand, and low volatility.

What are the average rental yields in Germany?

Typically between 2% and 5% annually, depending on the city and property type.

Which German cities are best for property investment?

Berlin, Munich, Frankfurt, Hamburg, Leipzig, and Dresden lead for returns and stability.

Do foreign investors face restrictions in Germany?

No, foreigners can freely buy, own, and sell real estate without residency requirements.

How risky is the German property market compared to other EU countries?

It’s among the safest, with lower volatility and stronger legal protection than most European markets.

Conclusion

The German real estate market is stable and well-suited for long-term investments. It is important, however, to consider taxes, regulations, and regional differences to ensure the best returns. Strong demand in urban areas, combined with limited supply, continues to support property values, while emerging cities offer attractive opportunities for rental income. Careful planning and understanding of local market dynamics can help investors achieve both steady income and long-term capital growth.